In partnership with the Consumer Credit Counseling Service of Central Oklahoma (CCCS), Pioneer Library System (PLS) staff presented numerous six-week Fiscally Fit Bootcamps to library staff and vital community partners such as municipal employees, tribal groups, local utility workers and technology centers in all 12 library communities.

Advanced Planning

The Fiscally Fit Bootcamps were held over three Smart investing@your library® grant cycles for a total of nearly 11 years. Because the grant applications required in-depth information, we confirmed our partners, instructors and target audience three or more months ahead of the grant application. PLS partnered with employees of local governments, a technology school and three tribal groups to build skills regarding financial health.

Each boot camp covered:

- Your Fiscal Strength (examining money attitudes)

- Booyah for Your Budget (how to build savings and spending plans and stick to it)

- Credit Crunches (understanding credit reports and credit scores)

- Basic Training for Borrowing (examining loan types and loan features)

- Debt Drills (strategies for paying down debt)

- Staying Fiscally Fit (saving and investing for longer-term goals).

After the 2013 Moore and Oklahoma City tornadoes, PLS and CCCS created a tailored Fiscally Fit Bootcamp experience for families who suffered storm-related losses.

Our grant goals were to increase community partner employees’ access, knowledge, skills and confidence relating to savings and investment resources through the series and to enhance partnership and relationship building between the local library and the partnering community organizations including increased knowledge of library programs and services.

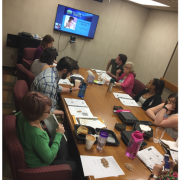

The majority of our bootcamps were held during lunch hour on the community partners' worksites to remove as many barriers as possible for attendance. Because of the high level of engagement and hands-on activities, we were challenged to keep the program within the hour goal.

Marketing

Because our grant applications required concrete target audience plans, our overall promotion began at one year or longer with our initial conversation with leaders of the following groups. All groups below promoted via internal emails along with reminders of upcoming sessions:

- Technology school

- City Human Resources departments

- Tribal Human Resources departments

- PLS Human Resources departments

For some entities we created an internal, promotional flyer utilizing a CCCS branded template. To promote our storm-specific bootcamp we created a press release, posted the event on our calendar of events; created paper and digital flyers shared via social media, the library website and at outreach events.

Budgeting

The three grant amounts varied each cycle depending upon our activities.

Bootcamp expenditures included:

- Fee for instructor-led sessions, copies of their workbooks and bootcamp t-shirts

- Lunch: Six catered meals to include attendees, instructors(s) and library staff

- Graduation cake

- 2-4 relevant prizes given away at the last session: paper shredder, fire safes, organizing bundles

- Plastic storage tubs

- Metal utility cart

- Roll of tickets for giveaways

- Bag of dried pinto beans for a specific activity

For each attendee:

- Calculators

- Pens

- Branded RFID credit card sleeves

- Accordion folder

Cost-cutting suggestions: Offer the program virtually, plan so it's not during mealtime or connect with financial community partners for a similar program and materials at no cost. Work with community contacts to request sponsorship for food, supplies, and instructor(s) plus curriculum materials.

Day-of-event Activity

There is a lot of set-up and equipment needed on the day of the program, including having a printed sign-in sheet and pre- and post-tests, tables, chairs, computer, screen/monitor or projector, presentation remote and speakers. We also needed a thumb drive for presentations and dependable Wi-Fi.

We set up space for catering and put out a table to display library materials. We filled outreach tubs with materials such as FINRA Foundation and other relevant financial flyers and booklets along with physical, financial education library books, library card applications, library cards, laptop to make cards on-site, and a branded table cover. We included extra writing utensils, notepads and catering materials such as paper towels, napkins, plates, cups and silverware. At our event host locations, we often worked closely with a point person who helped us set up and clean up.

One to two PLS staff members were sufficient for each bootcamp.

Program Execution

All but one bootcamp was scheduled for one day a week during lunchtime for six weeks. The Resilience in the Heartland Bootcamp, held for 2013 storm survivors, was an evening, four-week series. The majority of our bootcamps were held at off-site locations, usually at the attendees’ place of employment.

The ease of travel, plus providing lunch, made this program attractive to attendees and their supervisors.

Session one included some basic housekeeping topics such as sharing the agenda, library resources, taking the pre-test, handing out materials and the explanation of how to earn tickets for the drawing. Tickets were provided as an incentive for attendance and class participation. The final session included a post-test, group pictures, celebrating with a cake and the ticket drawing for prize winners.

Each bootcamp series varied in attendance with a range from 15 to 50. PLS met our specific grant goals for each grant cycle. An amazing outcome is the continuation of PLS staff sharing tips they learned, attending library stand-alone financial classes, and seeking more information.

One class member shared her testimony: “I want to talk about my finances before and after taking the class. Before the class I didn’t have a plan on how to get out of debt. I seemed to be getting nowhere fast. After taking the class I realized there was a way to take control and reach my goal of being debt-free. I started paying off the small bills and then taking the money to pay more on the larger bills. Now I am happy to say that all I owe is my mortgage on my house. I have paid off my car and all doctor bills as well as credit cards. I am so thankful that I took the class. I was unsure before taking the class of my chances to pay everything off. Now I am looking forward to getting my house paid off in less than five years. It was one of the best decisions I have made. Thanks to those responsible for making the class possible.”

Advice

Contact us at businessservices@pioneerlibrarysystem.org. We love to share best practices.

You can also reach out to financial education groups within your community to see if there is a similar type of program already in place. Look for local sponsors to support your event.

Be creative when choosing your program audience and consider taking the program to your audience outside of the library. Use pre and post-tests to gauge learning outcomes and consider giving memorandums of understanding for your presenters and target audience if not for the public.