Programs

Try these activities as stand-alone programs or add them to a storytime program or tween/teen book club.

PENNY PINCHERS’ PARTY

Kids become party planners, creating Planning Boards for their clients while staying on budget. With a budget of $100, the players take turns selecting items from a party warehouse managed by the program facilitator. After five turns, players share their plans with the group and explain their choices. The facilitator, or the group as a whole, may opt to select a Party Champion—the participant who plans the most entertaining or creative party while keeping expenses within budget. Free materials for this game are available.

PAIRS WELL WITH: A Credit Card Takes Charge by Kimberly Wilson

BANK OR STORE ROLEPLAY

Have kids act out going to a bank and opening a savings/checking account or applying for a loan. In a separate simulation, kids can visit a pretend store and decide which form of payment makes the most sense at the point of purchase. It could be cash, debit card, credit card, or some other form of payment. In both simulations, participants can learn about fees, interest rates, and other considerations to keep in mind when making a financial transaction (for example, will I be able to pay back any money I borrow and do so on time?).

PAIRS WELL WITH: Paper or Plastic by Okeoma Moronu Schreiner

DEWEY DOLLARS CAMPAIGN

The Florence County Library System in South Carolina offered a program to incentivize young readers to explore the library’s financial education collections. By reading specially designated books and completing a brief form about the money lessons they learned, participants could earn and save Dewey Dollars redeemable for small prizes. Download Dewey Dollars that you can print and cut out.

PAIRS WELL WITH: All the titles on the book list by making the books eligible for earning Dewey Dollars

PET CENTS

Players adopt a pet—and take on the financial responsibilities of pet ownership—as they visit various stations around the room. At each stop, players engage in financial transactions with an assistant/cashier (i.e., an adult or older kid), spending and receiving money until the timer runs out. Along the way, they are faced with unexpected events that could result in a financial windfall or expense. All transactions are tracked on the player’s Pet Card. The goal of the game is to meet a pet’s needs while retaining as much money as possible. Free materials for this game are available.

PAIRS WELL WITH: Katie the Catsitter by Colleen AF Venable

PIGGY BANK CRAFT

Lead kids in decorating their own ceramic or cardboard piggy banks. (Try reaching out to a local credit union or craft store to see if they can provide the materials.) Afterwards, put the piggy banks on display, along with notes explaining what the children are saving for. Explore ways that kids in other countries earn, save, and use money as a way to focus on how children participate in different economies. You could even discuss the origins of the piggy bank (hint: it goes back hundreds of years).

PAIRS WELL WITH: I am Money by Julia Cook and Garrett Gunderson or Breaking the Piggy Bank by Martha Maker

MOCK JOB FAIR

How can younger children turn their hobbies into careers? Invite a kid-friendly career counselor for a mock job fair to explore the wide, wide world of work. Think broadly about the kinds of hobbies presented and talked about in the program. Consider presenting hobbies accessible to a variety of cultural, geographic, and socioeconomic backgrounds.

PAIRS WELL WITH: Leena Mo, CEO by Deena Shakir, and the “Earning It” game at tm4k.ala.org

FINANCIAL BADGE DAY FOR YOUNG SCOUTS

Scouting organizations have badges that require members to learn the basics of budgeting, comparison shopping, financial planning, and financial decision-making. Work with Girl Scout and/or Scouting America leaders to organize a badge day event during which scouts can learn essential money skills and meet badge requirements.

PAIRS WELL WITH: Camping, Here I Come!: Keeping a Budget by Lisa Bullard (for younger scouts)

MEAL PLANNING ON A BUDGET

In partnership with a nutritionist and a financial educator, take kids and parents on a field trip to a local grocery store for tips on smart meal planning and how behavioral science affects our spending choices. There are lots of money math lessons, too. Grocery stores love to be involved.

PAIRS WELL WITH: Thank You, Omu! by Oge Mora

PICTURE YOURSELF AN ENTREPRENEUR

Invite your teen book club or teen advisory group to create their own comic that demonstrates earning, spending, or saving money. If your library has the capacity, this program could incorporate hands-on lessons in animation.

PAIRS WELL WITH: Down to Business by Fenley Scurlock and Jason Liaw

MONEY MOVIE (OR TV) NIGHTS FOR TEENS

Screen a series of feature films that have money themes. Each film may be introduced by a financial educator and followed by a short workshop or activity, such as a library-based scavenger hunt to search for answers about money-related questions relevant for teens. This also works well for family audiences.

PAIRS WELL WITH: Money Out Loud: All the Financial Stuff No One Taught Us by Berna Anat

FAMILY FINANCIAL WELLNESS WORKSHOPS

Through intergenerational activities, help parents model good financial habits and teach their children about money. Families can learn how to make a financial plan, research money decisions, save for a goal, and prioritize spending. The program can identify roles for all family members—children, teens, and adults—in achieving a household’s financial objectives.

PAIRS WELL WITH: Gigi Shin Is Not a Nerd by Lyla Lee

BUDGET GIFTING

Invite a budgeting expert to talk about ways to save money by creating homemade gifts. The expert can lead a demo, and kids can take home a ready-to-give present. Brainstorm handmade gifts for people on your attendees’ giving lists. Explore the role and meaning of gift-giving across world cultures.

PAIRS WELL WITH: When Grandma Gives You a Lemon Tree by Jamie L.B. Deenihan

Resources

Continue your journey to provide financial education to your young patrons with these resources.

- National Standards for Personal Financial Education (from the Jump$tart Coalition and the Council for Economic Education)

- Financial Literacy Education in Libraries: Guidelines and Best Practices for Service

- Thinking Money for Kids

- Council for Economic Education

- Jump$tart Coalition

- Next Gen Personal Finance

- Federal Reserve Education

- U.S. Mint Games

- Financial Literacy in Public Libraries LibGuide

- Webinar: "They asked you for WHAT?!" Helping Your Patrons Outsmart Scammers and Avoid Fraud

Free online games

ALA, in partnership with the FINRA Foundation, has created a collection of free online games to teach children basic financial skills related to earning, saving, and spending money.

The eight games are designed for children ages 5 to 12 and include lively characters that appeal to young learners. Find them at tm4k.ala.org!

| Penny Pinchers' Party: You are the best party planner in town, and your friends want your help. Choose from free items or buy new things online as you create the perfect party on a budget. |

| Pet Cents: Pets are great, but it costs money to take care of them. Watch your available funds, and buy things your pet needs and wants to keep it happy. |

| Making Mooo-lah: Do you think you have what it takes to manage a farm and make strategic financial decisions? |

| Currency Catcher: "Currency" means money -- both paper money and coins. In these challenges, learn about bills, coins, and what they are worth. |

| Earning It: Select Grace, Emma, or Kenji to follow their story and learn how they transformed their childhood interests into successful careers. |

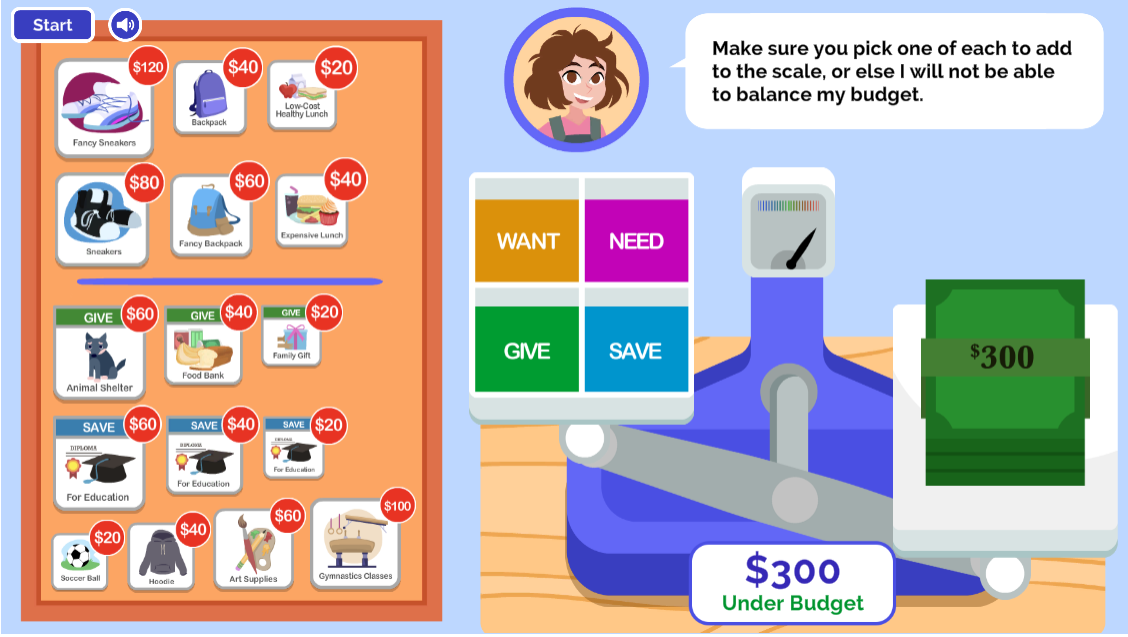

| Balance my Budget: A budget is a plan for using and saving the money available to us. Can you sort through wants and needs to balance a $300 budget? |

| Money Trail: Every day, we make decisions about earning, saving, and spending money. Starting with $500 in your account, follow your own Money Trail. |

| Let's Deal: Follow Jayden's journey at a farmers’ market as he tries to swap goods and learn about money. |